Introduction to Mobile Payment Systems in Africa

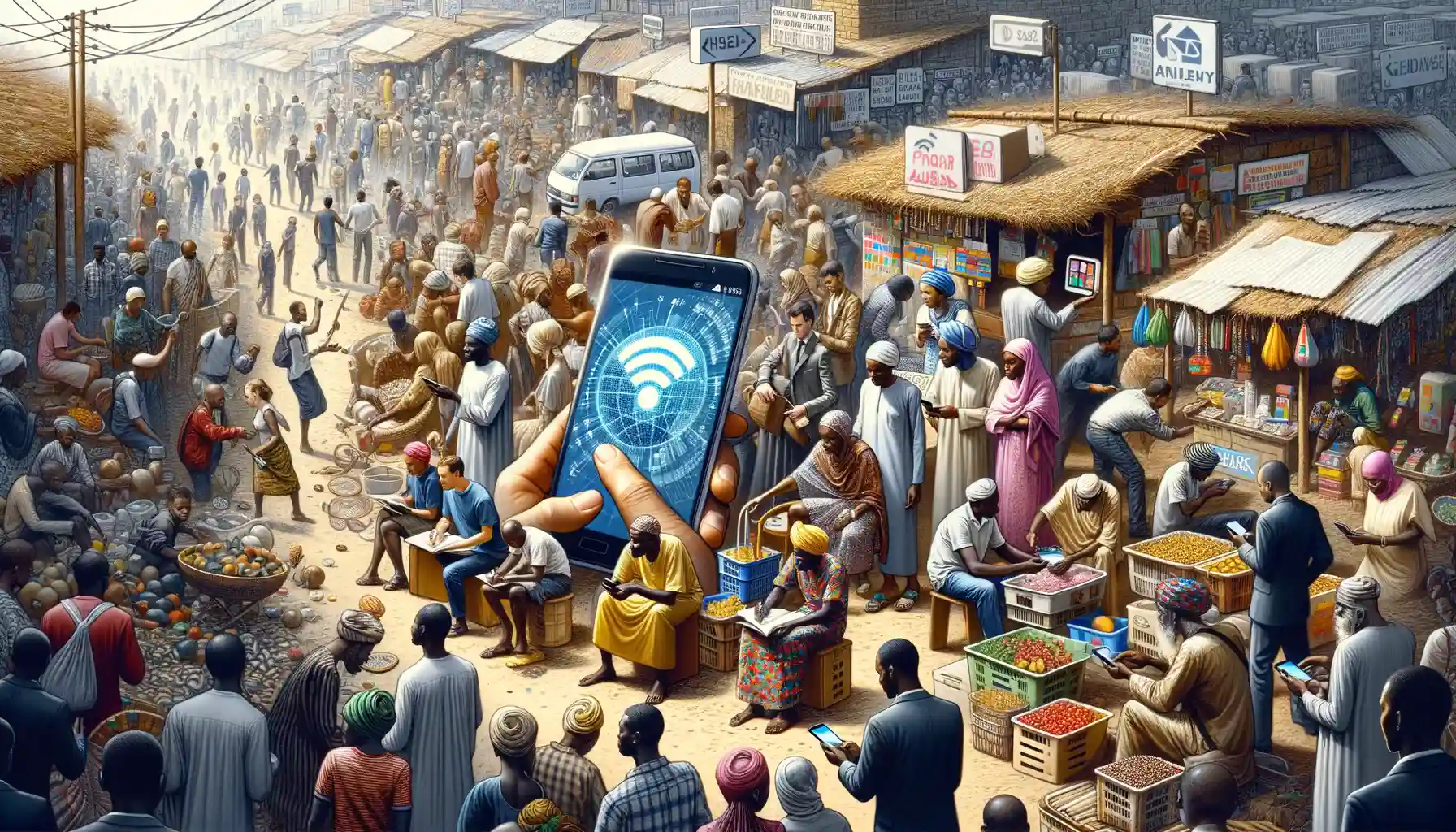

Imagine walking into a bustling market in Lagos or a crowded bus station in Nairobi. No cash? No problem. Across the African continent, mobile payment systems are transforming the way people buy, sell, and save. From paying for a cup of tea in Kenya to transferring school fees across borders, mobile technology has woven itself into everyday life. But how did this digital revolution take hold?

The Rise of Phones Over Wallets

Africa, often called the “mobile-first continent,” skipped the landline era and jumped straight into the arms of mobile technology. With over a billion mobile connections, even in remote villages, phones have become lifelines for communication, banking, and beyond. Services like M-Pesa, launched in Kenya, were game-changers, proving that you don’t need a bank account to be part of the financial world.

What makes these systems so magical? Just a SIM card and a feature phone can turn anyone into an entrepreneur or financial wizard:

- Instant Transfers: Send money quicker than you’d grab your wallet.

- No Bank Needed: Financial services for communities once left behind.

- Accessible Payments: Buy groceries or pay electricity bills with a simple text message.

The beauty of mobile payments lies in their simplicity and inclusivity, bridging gaps that banks simply couldn’t. It’s like holding the future in the palm of your hand!

Key Drivers of Mobile Payment Adoption

Why People are Choosing Mobile Payments Over the Old Ways

It’s happening everywhere: the bright screen of a mobile phone replacing the clinking of coins or rustle of cash. Why? People aren’t just drawn to mobile payments because they’re trendy; it’s because they solve real, everyday challenges in ways that feel almost magical.

For starters, accessibility is a game-changer. Imagine living in a rural village where the nearest bank is a two-hour bus ride away (if the bus even comes that day). With mobile payments, your “bank” is suddenly in your pocket. The unbanked population across Africa now has a bridge to financial services, no matter where they live.

Then there’s *pure convenience*. Need to send money to your cousin in another town? No need to stand in line for a remittance service. Just tap, swipe, and—done!

- Affordability: No hidden fees or transaction costs that eat up your hard-earned cash.

- Safety: Carrying cash makes you a target; carrying a phone? Not so much.

- Speed: Payments happen in seconds, whether you’re buying groceries or paying school fees.

The Role of Innovation in Winning Hearts

Africa leads with ingenuity, and mobile payments shine brightest where big ideas meet local needs. Take M-Pesa in Kenya, for example—it’s not just an app; it’s lifeblood for millions. It lets farmers get paid faster for their crops, urban workers send funds home instantly, and small businesses thrive without needing complicated point-of-sale systems.

Add to that the rise of smartphone penetration. A decade ago, these devices were rare jewels. Today, they’re as common as water pumps. Thanks to affordable models flooding the market, even those with modest incomes can access advanced digital tools. And when you pair those tools with changing mindsets around technology, especially among youth? You’ve got a revolution under way.

This isn’t just about transactions; it’s about trust, empowerment, and a future built on connection. Mobile payments aren’t just growing—they’re becoming inseparable from how life thrives across the continent.

Impact of Mobile Payments on African Economies

Transforming Local Economies, One Transaction at a Time

The ripple effect of mobile payments on African economies is nothing short of revolutionary. Picture this: a bustling market in Nairobi where a small vendor effortlessly accepts payments via their phone, enabling them to cater to customers far beyond their immediate neighborhood. That’s the power of mobile payment systems—they’re not just tools; they’re lifelines for businesses and individuals alike.

For millions who were previously excluded from traditional banking, these systems are an open door to financial freedom. From rural farmers receiving payments instantly after harvest to entrepreneurs paying suppliers with a quick tap, the impact is palpable. In fact, in countries like Kenya, over 80% of adults use mobile money platforms such as M-Pesa—transforming daily life and fueling local economies.

- Access to credit: Mobile payment apps now provide micro-loans, helping small businesses grow faster than ever.

- Streamlined remittances: Families across borders can send money home within seconds, cutting out middlemen and hefty fees.

- Job creation: Digital wallets have spurred new industries, from financial tech startups to mobile agents.

A New Economic Reality

Mobile payments are painting a vivid new picture of economic inclusion across Africa. Think about how much can change when financial transactions, once bogged down by bureaucracy, suddenly become as swift as sending a text message. Small towns that lacked banks now hum with opportunities, as mobile money creates a bridge between the formal and informal economies.

Rural women selling fresh produce, young creatives launching digital ventures, street vendors doubling their profits—all these stories reflect the bigger truth: mobile payments unlock potential where it was once stifled. With each tap and transfer, Africa’s economy grows not in whispers, but in bold, groundbreaking strides.

Challenges Facing Mobile Payment Systems in Africa

Unpacking the Hurdles of Mobile Payments in Africa

Picture this: you’re standing in a bustling market in Nairobi, smartphone in hand, ready to pay for that gorgeous handwoven basket. But wait—no signal! This is one of the many challenges mobile payment systems face across Africa.

First off, let’s talk about infrastructure gaps. Reliable internet and mobile connectivity aren’t a given in vast rural areas where millions of Africans live. Without 4G towers or even stable 3G coverage, digital payments often hit a dead end.

Another hitch? The question of affordability. While mobile payment platforms like MPesa have transformed financial inclusion, transaction fees still pinch—especially for low-income users. Imagine paying a significant chunk of your small earnings just to send money home.

And let’s not forget the elephant in the room: trust. Many potential users hesitate to jump on the mobile payments bandwagon due to concerns about fraud or lack of consumer protection.

- Poor smartphone access for lower-income groups.

- Regulatory bottlenecks stifling innovation and competition.

- Cultural hesitations around transitioning from cash to virtual payments.

These obstacles create a bumpy road—but with each challenge comes the opportunity to innovate and adapt.

Future Trends and Opportunities for Mobile Payments in Africa

The Mobile Payment Revolution: What’s Next?

Africa’s mobile payment journey is just beginning, and the future looks as thrilling as a buzzy open-air market on a Saturday morning. Imagine a world where your phone not only replaces your wallet but connects you to a thriving digital ecosystem. That’s where we’re headed.

The rise of next-gen technologies like blockchain and artificial intelligence (AI) could take mobile payments beyond just transactions. Picture AI-powered chatbots automatically handling loan repayments or blockchain networks ensuring every shilling or rand reaches its rightful destination. It’s no longer a dream—it’s a blueprint in action.

- Cross-border mobile payments: With platforms breaking down borders, migrant workers may soon send money home with fewer fees and delays.

- Biometric authentication: Fingerprint scans and facial recognition are becoming the new “PIN codes,” making payments faster and safer.

Opportunities for Digital Empowerment

What’s most exciting is how this tech could transform lives in rural Africa. Farmers could access micro-loans via their phones, enabling them to buy seeds or fertilizers without visiting a bank. Vendors might use mobile payments to tap into international markets without ever leaving their stalls.

Simply put, these trends aren’t just reshaping wallets—they’re rewriting destinies.